LA R-1353 2021-2024 free printable template

Show details

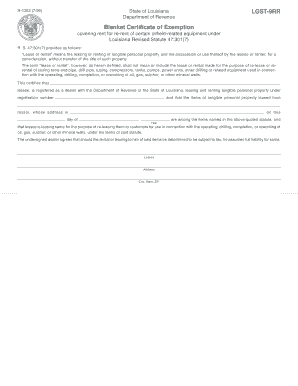

R-1353 7/99 State of Louisiana Department of Revenue LGST-9RR Blanket Certificate of Exemption covering rent for re-rent of certain oilfield-related equipment under Louisiana Revised Statute 47 301 7 R. S. 47 301 7 provides as follows Lease or rental means the leasing or renting of tangible personal property and the possession or use thereof by the lessee or renter for a consideration without transfer of the title of such property.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 47 301 2021-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 47 301 2021-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 47 301 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lgst 9rr form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

LA R-1353 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 47 301 2021-2024 form

Sales Tax Exemption Certificate Form is needed by:

01

Non-profit organizations, churches, and other religious institutions that are exempt from paying sales tax.

02

Government agencies that are exempt from paying sales tax.

03

Businesses that have a valid reason for exemption from paying sales tax, such as purchasing goods for resale or manufacturing.

Steps to fill out Sales Tax Exemption Certificate Form:

01

Begin by filling out the top section of the form with your personal information, such as your name, organization name, and address.

02

Check the appropriate box that best fits the reason for your exemption from sales tax.

03

Provide the sales tax number of the vendor whom you are purchasing the goods from, if applicable.

04

Provide a detailed description of the goods or services you are purchasing.

05

Include the total amount of the sale, including any taxes that may be applied.

06

Sign and date the form.

07

Provide any additional information required by the state in which you are making the purchase.

08

Submit the completed form to the vendor or seller.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 47 301?

47 301 is a numerical value or a specific number. It does not have a defined meaning or context without further information.

Who is required to file 47 301?

Form 47-301 is a form used by the United States Department of State for the declaration of an organization as a terrorist organization. Therefore, it is not something that individuals are required to file. Rather, it is typically filed by the government agencies involved in counter-terrorism efforts.

How to fill out 47 301?

Form 47-301 is used for requesting issuance of a Canadian patent or certificate of supplementary protection. Here are the steps to fill out this form:

1. Start by providing the applicant's name and address in the top left section of the form.

2. Indicate the reference number assigned by the Canadian Intellectual Property Office (CIPO) for the application, if applicable.

3. Fill in the section titled "Title of Invention or Product." Provide a clear and concise title that accurately describes the invention.

4. In the "Inventor(s)" section, list the full name(s) of the inventor(s) along with their respective addresses.

5. Move to the next section, "Priority Application Data," if applicable. Provide details of any corresponding priority applications filed in foreign countries, including the filing date, country, application number, and the conventions or treaties under which the priority claim is made.

6. In the "Nature of Concession for Which Application is Made" section, select the appropriate options that describe the type of patent application being filed (Standard Patent, Certificate of Supplementary Protection, etc.).

7. The next section, "Statements Required Under Section 37 of the Patent Act (If Applicable)," must be completed if there are any considerations relevant to section 37 of the Patent Act. If not applicable, simply skip this section.

8. Indicate your request for a search report in the "Search Report Requested" section. Tick the appropriate box to indicate whether you want an international search report or Canadian search report.

9. If you have any specific instructions for the Patent Office, enter them in the "Remarks" section.

10. Sign and date the application at the bottom of the form.

11. If an agent is acting on behalf of the applicant, the agent should provide their name and address in the "Agent or Correspondence Address" section.

12. Once all the sections are completed, review the entire form for any errors or omissions.

13. Make copies of the form for your records and submit the original form along with the necessary fee to the CIPO according to their guidelines for filing patent applications.

It's worth noting that the instructions provided here are a general guideline, and it is advised to consult the official instructions or seek legal advice when filling out legal forms.

What information must be reported on 47 301?

Form 47-301 is not a standard form, and there is no specific information that must be reported on it. It is important to note that the reference to "47-301" could pertain to a form used in a specific organization or jurisdiction. If you are referring to a particular form, please provide more context or details to accurately address your query.

What is the penalty for the late filing of 47 301?

The penalty for the late filing of Form 47 301 depends on the specific rules and requirements of the jurisdiction where the form is being filed. Form 47 301 does not have a universal meaning or purpose, therefore the penalty for late filing would vary depending on the nature of the form and the governing jurisdiction. It is important to refer to the specific rules and regulations for the correct penalty information related to the late filing of Form 47 301 in a given context.

How can I send 47 301 to be eSigned by others?

When your lgst 9rr form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in 47 301 without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your lgst 9rr form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out the 47 301 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign lgst 9rr form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your 47 301 2021-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.